Understanding How Credit Works

Credit is the subject everyone wishes they were taught in high school. Let’s keep the nostalgia of high school going and compare your credit score to a grade point average. The more A’s you have the better your grade point average is. The D’s and F’s lower your grade point average. Credit works in the same way. The more positive marks you have, the higher your credit score will be, while negative marks bring your score down.

In this article, we’ll teach you how your credit scores are determined and what you can do to raise them using our simple tricks.

How is your score determined?

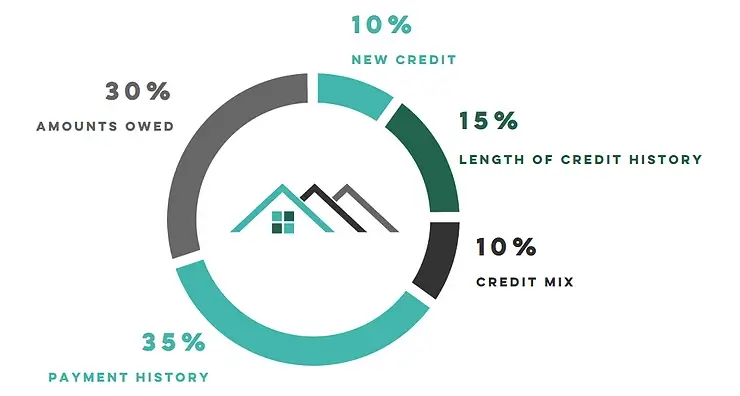

There are five key things that make up your credit score. The diagram below shows what they are and how much they weigh into your score. Keep in mind, these numbers are for the general population and can change based on your unique situation.

Payment History – 35%

The biggest part of your credit score is your payment history. Your payment history is made up of both installment (mortgage, car payment, etc) and revolving (credit card) payments. Installment payments typically take more precedence over revolving payments. One of the best ways to improve your credit is to make consistent on-time payments.

Amounts Owed – 30%

Amounts owed is the next biggest part of your score. Credit scores are affected by your utilization of credit or percentage of available credit being borrowed/used. Credit algorithms see borrowers who reach or exceed their credit limits as potential risks. It’s a good idea to keep your balances low. As a rule of thumb for scoring purposes keep your balances under 30% of your limit.

Length of Credit History – 15%

This part of your credit score looks at the length of time all of your credit accounts have been open. It also includes the time since an account’s most recent transaction. Newer credit users could have a more difficult time achieving a high score than those who have a credit history since those with a longer credit history have more data on which to base their payment history.

New Credit – 10%

In today’s society, we use credit more than ever. It’s okay to open a new account. However, opening several new credit accounts in a short period of time can signify greater risk – especially for borrowers with a short credit history.

Credit mix – 10%

Having a healthy mix of revolving credit and installment credit will factor into your score. This provides more depth to your credit profile. This won’t have much of an effect on your credit score unless you have a limited credit history.

Raising Your Credit Scores

Knowing how scores are calculated will give you a great place to start working on your credit. If you want to get it done quickly you can use these five tricks to increase your credit scores today.

Get a Secured Card

Credit cards are necessary for scoring purposes. A secured card is a good option for someone who may not be able to get approved for a conventional credit card. This credit card is secured by an initial deposit made by the borrower that is the same amount as that card’s limit.

Overusing this can hurt your credit so make sure that you keep your balances low. For the best results, keep your balance under 30% of its limit. ($90 on a $300 card)

Make sure the secured card you sign up for reports to all three credit bureaus. Typically bigger banks and credit unions provide the best options for secured cards.

Request higher Limits on Credit Cards

If you find yourself in a tight position and unable to pay credit cards down enough to make an impact, this option may be for you.

30% is the magic number when it comes to credit card balances. Sometimes to keep it under that mark, you may need to request a higher limit. You can do this by logging into your account online, or by calling your creditor.

While this is a great option to help scores, it should be used wisely. If you are able to, paying down cards will be a better decision for your overall financial health.

Become an Authorized User

This can help your scores by adding credit history to your credit profile.

If you have a family member or close friend who is willing to add you to their credit card, you will add all of that card’s history to your own credit history. It’s important that there are no late payments and balances are kept low for this to improve your scores.

This will not affect your family/friends credit and you will not need to receive a copy of the card. It simply adds their good trade line to your credit history, essentially allowing you to “piggyback” off of their good credit.

Dispute Inaccurate Information

Sometimes errors can occur on a credit report. To remove these, you can write a dispute letter to the credit bureaus. This will start an investigation into the item disputed on your credit. The account will then need to be verified by the creditor reporting the item.

Negotiating Collections

Most people don’t know that paying a collection can hurt your credit score temporarily. When a collection is paid it becomes a recent item.

To avoid this, you can call collection agencies and negotiate a “pay for deletion”. Essentially you will need to exchange payment for the agency removing the item from your credit report.

Doing these five things will help you clean up your credit report and boost your scores quickly so you can qualify for a home loan. If you would like some extra help with your credit, we offer a written credit plan for all of our clients to improve their credit scores. Reach out for more info!